R-E-S-P-E-C-T, what has momma left for me?

- Jul 11, 2023

- 6 min read

Updated: Jul 28, 2023

After a nearly five-year dispute and a two-day trial, a Michigan jury has decided that a handwritten document found in Aretha Franklin's couch is a valid will to her estate.

When Aretha Franklin died from pancreatic cancer in August 2018, it was thought that she had left behind no will for an estate worth millions.

What followed was a mystery of Stieg Larsson* proportions.

Initially believed to have left no written will, miraculously, two handwritten wills were found in her home in Detroit, leading to a dispute between her children over which should be recognised as valid.

The first will, dated June 2010, was found in a locked cabinet, and Theodore White II, Franklin's third child, argues that it is the legitimate will. Unsurprisingly, this document lists him and his daughter, as co-executors and mandates that two of his brothers take business classes before they can benefit from the estate.

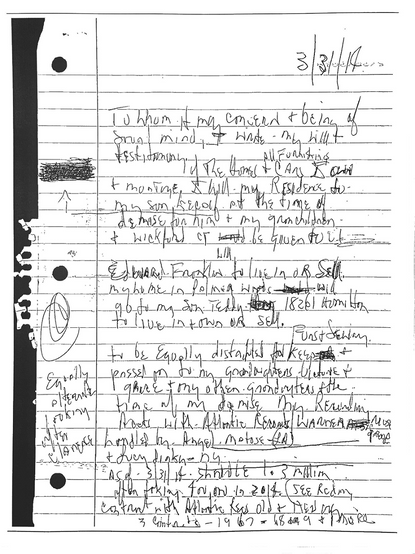

The first pages of each will. To me, both illegible. And the 2014 one was not only found under a cushion on the sofa, but also still within a bound notebook amongst other scribblings!

In contrast, two other sons, Kecalf and Edward, argue that a March 2014 will, found under a sofa cushion (presumably next to a TV remote, some coins and several dusty Maltesers), should be considered. This version names Kecalf as a co-executor and allocates Franklin's $1.2m mansion to him and his grandchildren.

Whilst they were arguing over the spoils, the estate plummeted in value. Initially estimated at $80m at the time of her death, unpaid taxes and recent valuations significantly reduced its value to just under $6m. That’s quite the drop, I assume she had a significant holding in Bitcoin.

This week, the jury decided the 2014 document, the one from the sofa, is a valid will, and being the latest one, thereby stands.

The 2014 will, now ruled valid, allows three of Franklin's sons to evenly split her music royalties and bank funds, while her youngest son, Kecalf, and his grandchildren inherit her primary residence, a gated mansion valued at $1.2m.

What Not To Do

This is an almost perfect case study in the consequences of poor estate planning.

Despite her illustrious career and (apparent) amassed wealth, it is clear she made no formal plans for the distribution of her assets after her death. The subsequent confusion and disputes among her heirs underscore the importance of having a clear, legally sound, and easily accessible will.

The case demonstrates the complications that can arise from not properly storing a will. While a will doesn't need to be stored in a bank vault, it should be kept in a secure location known to the executor or trusted family members. In the UK, the original will must be located, a copy does not suffice, so we always recommend it is at the very least stored in a fire proof safe at home if not lodged with the solicitors.

Also, the ongoing debate over the validity of the two different handwritten wills highlights the need for regular updates to the document and clarity about which version is the most recent. This should cause no problem in the UK as a will should be dated, however if you do update yours, be sure to destroy the older one. If anything, it prevents “what could have been” scenarios as beneficiaries can track the changes.

Finally, the severe drop in the estimated value of the estate exemplifies the importance of financial management and record keeping as part of estate planning. Trying to locate all assets and investments without a proper register can be a difficult task at the worst possible time. And as more of our key information is held online, this is set to become more and more difficult.

In the light of the above, and to provide a simple guide on how to navigate the sometimes complex process of estate planning, I've developed the RESPECT Guide to Estate Planning.

This acronym represents the key steps you should take to ensure your assets are handled according to your wishes, and to prevent potential disputes or losses.

R - Record your wishes clearly.

E - Engage in conversations with your loved ones about your estate plans.

S - Seek professional advice.

P - Plan ahead, don't procrastinate.

E - Ensure you have a backup plan.

C - Catalogue your assets and valuables.

T - Take caution, don't act recklessly.

Having a comprehensive and updated will is not just a document—it's an act of respect and care for those you leave behind.

On A More Serious Note

In the UK, when a person dies without leaving a valid will, their estate must be shared out according to certain rules known as intestacy rules.

Here's a brief overview.

Married or civil partners - If there are no children, the spouse or civil partner inherits the entire estate. If there are children, the spouse or civil partner inherits all personal property and belongings of the person who has died, the first £270,000 of the estate, and half of the remaining estate. The other half goes to the deceased’s children.

Children - If there is no surviving married or civil partner, then the children of the deceased will inherit the whole estate divided equally among them. If there's a surviving partner, they will inherit only if the estate is worth more than a certain amount.

Parents, brothers and sisters, nieces and nephews - These relatives only inherit if there is no surviving partner or children, with the estate being distributed in a specific order. Parents come first, then siblings (or their children if they died while the deceased was still alive).

Other relatives - If there is no surviving partner, children, parents, or siblings, then other relatives may inherit the estate, in a particular order prescribed by law.

If there are no surviving relatives - The estate goes to the Crown, in a process known as 'bona vacantia.'

Writing a will can help ensure that your assets are distributed according to your wishes and can simplify the process for your loved ones after your death. In the UK, writing a will is crucial for several reasons.

Control over Asset Distribution - A will allows you to decide how your assets, including money, property, and possessions, will be distributed after your death. Without a will, your assets will be divided according to intestacy laws, which may not reflect your wishes.

Protection for Your Children - If you have children under 18, a will allows you to nominate guardians to take care of them should anything happen to you. Without a will, the court will decide who will take care of your children.

Reduced Family Disputes - A clear, legally sound will can help to avoid family disputes over your estate, ensuring that your wishes are carried out and minimising the potential for conflict.

Tax Planning - A well-crafted will can help reduce the amount of inheritance tax that may be payable on your estate.

Charitable Gifts - A will provides the opportunity to leave a legacy to charitable causes you care about.

Funeral Wishes - Although not legally binding, a will can provide guidance on your wishes regarding your funeral or how you would like your body to be handled after death.

Writing a will is an essential aspect of planning for the future. It allows you to determine how your assets should be handled and who should care for your dependents, which can provide peace of mind and security for you and your loved ones. If your will needs updating, or worse if you have not got round to it, please do.

Aretha is not the only musician to not write a will or have it contested.

Prince left behind no known will, despite an estate estimated to be worth hundreds of millions of dollars. The lack of a will led to a complicated and prolonged legal dispute among his six siblings and half-siblings.

Amy Winehouse had an updated will that excluded her ex-husband Blake Fielder-Civil. However, it was reported that she may have been in the process of making a new will at the time of her death, which led to some contention.

Jimi Hendrix had no will. His estate, which has grown immensely since his death due to posthumous releases, has been the subject of multiple legal battles involving family members.

Bob Marley died without a will. In accordance with Jamaican law, his estate was to be divided among his wife and 11 children. However, the distribution of Marley's wealth and assets has been a point of contention over the years, leading to multiple lawsuits.

*And for those of you who picked up on the Stieg Larsson reference earlier but did not understand the relevance.

The author of the popular "Millennium Trilogy" including "The Girl with the Dragon Tattoo," passed away in 2004, before the release of any of his novels, without leaving a will.

This led to significant problems for his estate.

The entirety of Larsson's estate, including the rights to his work, went to his father and brother under Swedish law, bypassing his longtime partner Eva Gabrielsson due to their unwed status.

This situation sparked a lengthy and bitter dispute, as Gabrielsson argued that she should have control over Larsson's literary estate, given their long-term relationship and her deep involvement in his work.

The complexity of the case was further exacerbated by the financial success of Larsson's posthumously published books, which amplified the stakes in determining who would control his literary and financial legacy.

Cover Image - travelview - stock.adobe.com

Comments