2022 Mid-Year Outlook

- Jul 15, 2022

- 6 min read

The economic outlook has deteriorated markedly since the start of the year. Lingering inflation concerns have been compounded by the spike in commodity prices following the war in Ukraine and the supply chain problems arising from Covid lockdowns in China.

With inflation as the root cause of the problem, investors have found themselves in the worst of all world, with the price of bonds and stocks falling. 60:40 portfolios (a traditional starting point for many portfolios) are on track for their worst year since the financial crisis.

So, what is the outlook for the second half of the year and beyond?

In his latest analysis, Parmenion Investment ManagementManaging Director Peter Dalglieshdiscusses the key market events in his 2020 Mid-Year Outlook.

He describes 5 key takeaways from the year to date and looks ahead to the future. He also explains why, despite the ongoing uncertainty, there's still cause for long-term optimism.

In January, our 2022 market outlook anticipated less accommodative monetary and fiscal policies leading to slower growth, a withdrawal of liquidity, and a moderation in earnings growth (meaning the potential for lower equity valuations).

We maintained a cautiously positive approach as economies appeared to be recovering following the pandemic.

Six months on, much of this has happened, with notable variations. Inflation has been far stronger, more persistent and widespread than expected, made worse by the Russia-Ukraine conflict, forcing central banks to take action as they seek to re-establish their inflation-fighting credibility. As a result, markets have weakened materially across almost all asset classes, giving investors few places for refuge.

The increased correlation between growth and defensive assets is rare, and a real challenge for investors. History suggests it’s likely to be relatively short-term, so for long-term investors, this may represent an opportunity from which to build sequential returns.

Here are 5 key takeaways from the first half of the year.

1. Tighter financial conditions drive lower valuations

Central bank action to rein in inflation by aggressively raising interest rates and tightening financial conditions has caused heightened market volatility.

The resulting bond market re-pricing has taken yields from close to zero (or even negative), to positive territory very quickly. This ‘discount rate’ adjustment is used by investors to work out the fair value of future earnings for companies, which inevitably led to lower equity valuations and a derating of market multiples around the world.

2. Economic resilience persists

Despite a tougher liquidity backdrop, tight labour markets are helping to support the consumer.

That, plus healthy corporate and household balance sheets mean economic activity measures such as the Purchasing Managers Index (PMI) are showing resilience. A PMI reading of 50 or above indicates expansion, and less than 50 indicates contraction.

Current levels show we’re managing to remain in expansion, though notably down from recent highs.

3. We're nearing peak inflation

The key challenge for central banks is preventing entrenched inflation.

Tight labour markets bring fears of wage inflation, and this is compounded by post-pandemic supply-side bottlenecks and the tragedy in Ukraine-all putting upward pressure on food, fuel, energy, and housing prices.

But there are signs that prices are becoming more stable, and in the case of commodities and transportation, even rolling over. Completed housing in the US is also due to pick up as units under construction are finished. Second-hand car prices are falling back from their highs as new car supply starts to outweigh demand.

Global supply bottlenecks are also easing as China relaxes their draconian zero covid policy. Combined with moderation in demand due to increased living costs, this is leading markets to expect inflation will be brought under control, so market implied long-term inflation expectations remain near the Fed’s 2% target.

4. Expect downward earnings revisions

Anticipated GDP growth slowdown and rising input costs make the earnings outlook more challenging, with analyst forecast downgrade widely expected.

Much of this already seems to be priced in. In a recent Deutsche Bank fund manager survey, 90% of respondents assumed a recession before the end of 2023. However, corporate earnings are still expected to remain reasonably robust.

In the forthcoming earnings season, companies will need to evidence their ability to handle cost increases, preserve margins and demonstrate resilience in sales growth and market share. Investors will expect updates on changes in inventory and the cash conversion cycle. Markets can be unforgiving to signs of operational weakness and so the stock selection is likely to be extremely important, representing an opportunity for active managers to add alpha.

5. Time to hold your nerve

With continued uncertainty over inflation, interest rates and recession, it’s no surprise that risk of strategies and caution have dominated so far this year.

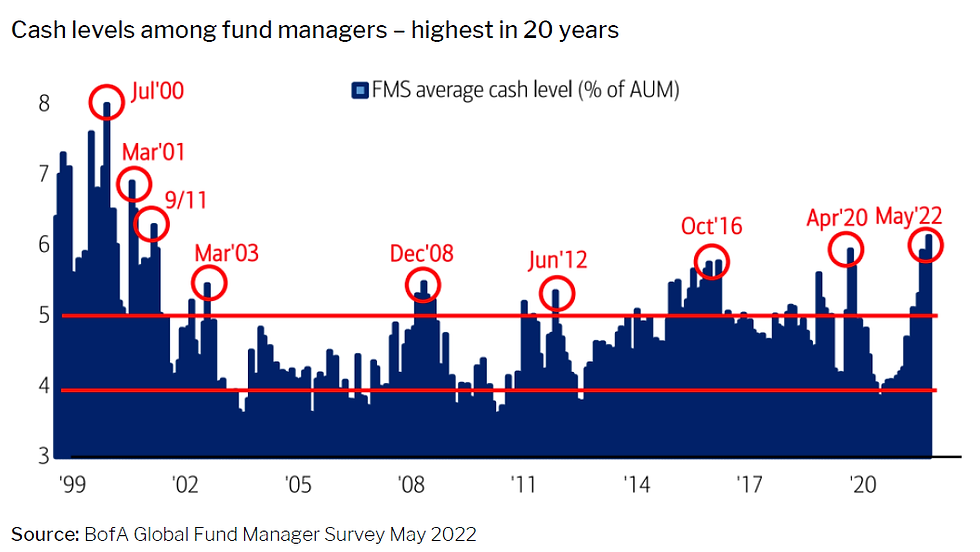

Cash positions are now the highest in 20 years, indicating widespread negativity. There’s room for upside surprise should things turn out to be better than feared though. Long-term investors will do well to remember that the benefits from compounding are usually at their greatest following periods of market weakness.

Looking Ahead

Liquidity, valuation and sentiment are currently under downward pressure.

Valuations have come back meaningfully, but not enough to single-handedly support a market recovery until there’s clear evidence of inflation falling back towards central bank targets.

At that point, investors will be more confident in predicting a peak in interest rates, and that will help to stabilise sentiment and underpin forecast valuations of future corporate cash flows.

Bond markets are already pricing in meaningful short-term overnight interest rate increases, with projections at the end of June of 3.8% by the end of 2023 in the US and over 3% in the UK-more than double the current respective base rates.

Inflation is not expected to revert to the low levels seen following the global financial crisis of 2008/09. The shift towards a more responsible and sustainable energy mix and away from ‘just in time delivery means central banks can be expected to retain their tightening bias.

We are not anticipating a V-shaped market recovery on the back of the Fed easing up on monetary tightening. If the Fed does increase rates by at least 1.5% by the end of 2022, the current flat yield curve will likely invert, a historically reliable predictor of a recession.

The cost of living crisis is squeezing disposable incomes and forcing people back into the labour market, so better equilibrium in supply and demand for labour, goods and services may well be reached over the next 12-18 months. More stable GDP growth can then be established, supporting our outlook of cautious optimism.

That said, the path ahead will likely be bumpy, with heightened volatility. As liquidity is withdrawn, risk aversion will increase. But with higher yields available in fixed interest, the conventional uncorrelated/low correlations between fixed interest and equities can be re-established, allowing diversified multi-asset portfolios to weather periods of uncertainty.

Future returns are expected to be modest by comparison to recent times, with income a greater contributor to total return. Quality, cash generative, strong balance sheet companies are expected to do well, with resilience and robustness driving the compounding of returns, rather than valuation re-rating.

We’ve become more positive on Global Government Bonds following the rise in yields, and with China actively pursuing monetary and fiscal policy easing, we believe the current valuations in China are attractive for long-term investors. The direction of the US dollar will play a meaningful role in investor risk appetite, and if inflation eases, the current dollar strength should lessen. This would be good news for Emerging Markets and the global economy but be patient-given the current breadth of economic uncertainty, it won’t happen quickly.

Final Thoughts

It’s been a testing and turbulent first half of the year so it’s understandable that investors may feel despondent and overwhelmed. It’s important to remember that market cycles have always been a feature of investing. Periods of weakness can present an opportunity for long-term investments in quality companies at lower prices, helping to support the compounding of returns over years to come.

Investors have reason to be cautiously optimistic when they remain disciplined and committed to their agreed investment plan.

In Summary

While risks remain, investors should remember that markets have already fallen a long way. So, even if we do end up in a recession, selling stocks now and buying them back cheaper at a later date would require an ability to time the bottom of the market in a way that very few professional investors, let alone retail investors, have historically been able to do. Therefore, we currently think that maintaining a neutral allocation to risk assets while bringing government bond positioning closer to the benchmark probably makes sense.

Any news and/or views expressed above are intended as general information only and should not be viewed as a form of personal recommendation. Please note past performance is not an indicator of future performance, investment returns can go down as well as up. If you want a personal recommendation, please get in touch.

Comments